Recently, I was investigating currency trading options for transferring my salary back to the United States from abroad. I wanted to assess several different currency companies in the industry to see who had the best rates, processes, and user interface. I started my search with MoneyCorp. Below is a review of my experience with MoneyCorp and a demonstration of how the currency exchange process works for the prospective consumer. This review has been revised on April 2018 to reflect some of the new advantages of Moneycorp and serve as a better Moneycorp review for people from all over the world – UK, USA, Europe or Australia.

Sign Up

One of the most complex aspects of signing up to exchange currency is the portion where you have to prove your identify. Particularly for Americans, this is a major obstacle that you have to combat due to the Anti-Money Laundering Act and the Corrupt Foreign Practices Act. These two provisions place stringent requirements on the financial industry that force them to comply and be extra diligent, particularly when they deal with those who hold an United States passport. The important aspect to realize about this process is that if your nationality is American, you will likely not be making a currency transfer the same day that you register for MoneyCorp’s website. In the UK

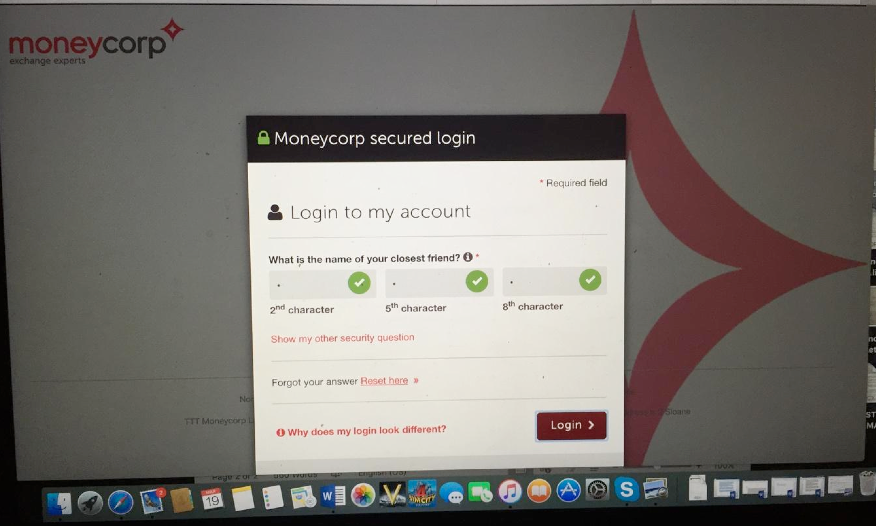

For MoneyCorp, their website was almost too secure! To start, look at their complicated method to answer a security question. Below in the picture, you will see my panel to enter the answer to my security question by numeric characters.

Moneycorp works in a very secure fashion. They want to be absolutely confident you are who you claim to be, and that by any means there will be no way to breach into your account. This is why there is a rather lengthy form which requires you to input all the information about your self, the trade and what it’s for, and ask you to create elaborated security questions they could use to identify you. I like that aspect of theirs – it may take a bit longer to sign up but once you do you are certain no one besides yourself or whomever you approved to this account will be allowed to use it.

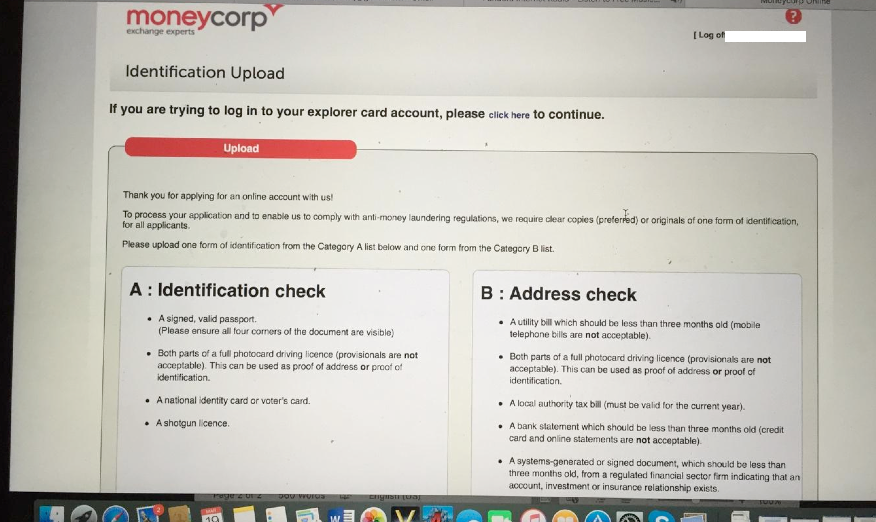

As a part of the sign up process you need to provide a proof to your domicile. In some countries like UK, Europe, Australia and some U.S states, you don’t need to do much more than give out a few details and they match it all in the back-end of their system and come up with a conclusion whether you are who you claim you are, and reside where you claim you reside.

With some US states and/or particular cases, you will need to be sending out documents. The trick with proving domicile is the need for a document that is not electronic to prove your physical address. This requirement is more complicated than one might think because of the provision of the Anti-Money Laundering Act that does not allow for electronic banking statements to be used to prove domicile due to the abundance of fraud in the marketplace. This is precisely why the consumer should not expect to complete a transfer the same day if he undergoes such procedure, as there is an extensive security process to complete that takes on average 3-5 business days, but as I mentioned most clients do not have to undergo this at all and get approved online by the system.

2018 update: The sign up process is getting quicker and quicker and requires less documents based on the fact that Moneycorp has improved its technology and integration of verification systems. Depending on where you are (most UK, EU and U.S states are included) you may be verified online without having to supply even a single document!

Anti-Money Laundering Act

The Anti-Money Laundering Act is targeted at making it more difficult to transfer money that was obtained from illegal crime. The amount of money that flags these sort of transactions is $10,000 USD, which makes currency transfers of this amount analyzed with a high level of scrutiny.

MoneyCorp Does Not Trade Every Currency

This is an important aspect to consider when deciding to work with a currency company. In my case, I was an American who is planning on working in both the United Kingdom and China next year as a professor, thus, I decided to inquire with MoneyCorp what their policies were for Chinese banks in order to ascertain what I would need to do to prospectively get my salary back to the United States. What I learned was that MoneyCorp does not trade Chinese Yuan, the closest that I could get was Hong Kong Dollars. MoneyCorp was also very suspicious about my employment and confirmed that they would need a written proof of the source of my salary in Asia to even consider trading it on their platform. This result serves as a lesson to the prospective consumer because if you are going to be transferring an amount that is substantially over $10,000 USD be prepared to show exactly where that money came from and be sure that the check or pay stub is in your name in order to avoid flags for money laundering.

That being said, it is important to note that MoneyCorp is a great company to use if you have some of the world’s more popular currencies such as: United States Dollars, Great Britain Pounds, Japanese Yen, and Australian Dollars. All in all Moneycorp handles more than 50 currencies.

The Transfer Itself

Once I was allowed, access to the transfer panel, I was contacted by a representative within four hours of being approved. The representative was quite eager to assist me in answering questions about the transfers. The important aspect to understand is that a transfer that is scheduled for certain periods of days in advance costs a different fee. What is also important to ask is which currency exchange rate will be applied to your prospective transfer. This, in higher transfer amounts, will make a substantial difference in the currency that is being transferred. What is important to remember is that you have the choice to quote an on the spot and a rate that is several days off.

An example of a rate that is quoted on the spot can be seen in transferring $100,000 USD to GBP. MoneyCorp quoted me 71,400.00 in GBP for my $100,000 USD on the spot and indicated that the official banking rate was 69,484.00 at that precise moment.

The MoneyCorp representative explained to me that they always tell customers a standard banking rate to show them how MoneyCorp’s rates are better. This is their way of showing their customers how their rate can and will be stronger if the customer uses their strategies to get the best rate on the range that they quote. MoneyCorp indicated that they range their quotes from 69,900.00 to 69,300.00 for transfers scheduled on future dates; however, they always try to provide the range on the higher end with a transfer on a fixed date when the market is reached. This is where you get your advantage with Money Corp when making a larger transfer because if you plan your days carefully according to the market rates, you can save a great deal of money on your transfer overall.

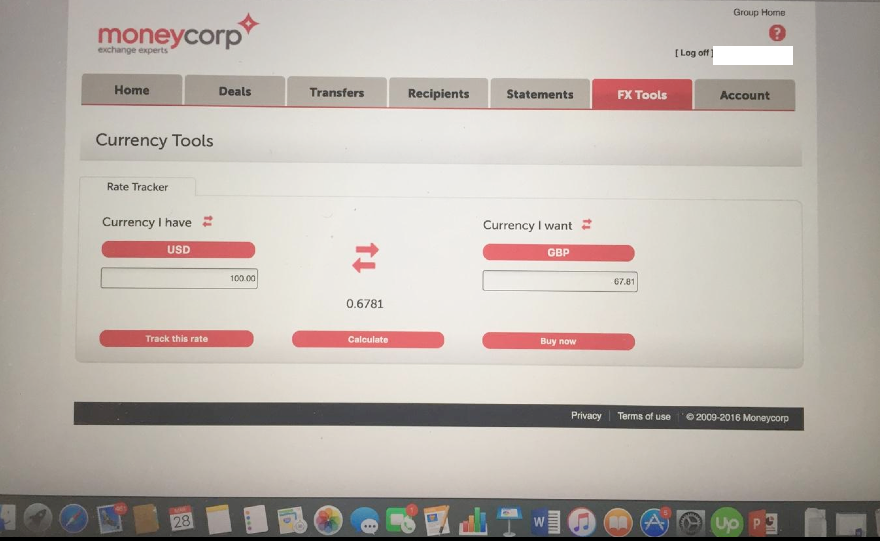

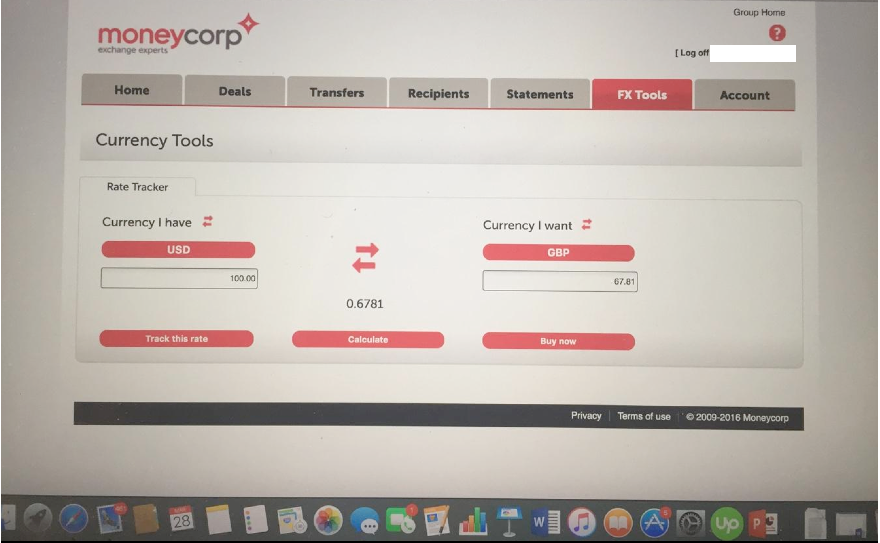

A smaller example of exchange rates is the exchange rate between $100 USD to GBP. On MoneyCorp the rate was 67.81 GBP and the official exchange rate that day is 70.16. Thus, MoneyCorp had a worse rate than the official rate because they value higher transfers. This would have made a substantial difference had one been transferring money for a real estate purchase, let’s say. The key to the success in this business is the negotiation with the trader.

What is important to remember is to factor in the transaction fee, which can be roughly $10 USD per transaction depending on how expedited your transaction is. Please note, that the minimum delay for a transaction at MoneyCorp is 2-3 business days, thus, it is best to plan accordingly. Here is a photograph of their currency transfer interface that allows the user to calculate with the varying currencies and their corresponding rates.

The representative at Moneycorp was very helpful to me in explaining my options. What I was unware of previously was that there are many different currency transferring options that can help consumers get better rates. Where currency trading becomes an art form is timing these transfers to get the best rate possible. The Moneycorp representative explained to me the value of forward contracts, spot contracts, stop loss orders, and limit orders. Not everyone of these was best for my small transfer; however, it was useful to learn about these transfers for my prospective larger transfers.

For my particular case, the representative recommended to play with the numbers in the market in order to get the best rate possible. He mentioned limit orders in which I would set a higher exchange rate in the coming weeks and then when and if the market hit that rate, the rate would be exchanged. He mentioned a stop loss order to set a minimum rate that I would be willing to trade and when and if the market reached that rate, it would be automatically traded. For those who are more cautious, he discussed a spot contract with me that ensures an immediate trade of the currency at the rate in the market. This option is good for when there is an expected downturn in the market. Lastly, he mentioned the forward contract option, which allows you to sell your currency rate in the future at the rate you select today.

He went amazingly deep into the tricks of the trade (literally!), and all of that before I ever commenced even a single transfer with the company. This is such a great service to be receiving. This is particularly useful if one is considering buying a home overseas because these efforts could end up saving you thousands of dollars if you follow their advice.

Moneycorp really did give me a fantastic analysis and explanation for their rates, and now the readers of this blog will enjoy ever better rates because clients I refer over to them get a waiver of all fees + better exchange rates! Whoohooo.

Trading

I used Moneycorp after I got the amazing deal for my readers with exclusive rates. I needed to move $10,000 to my UK account and I got it for a really, really, good rate! I was quoted at around 0.72 pounds for each dollar by the bank, and 0.75 pounds by Moneycorp. I saved $300 or roughly £235 on a medium sized transfer. If I were to transfer 100,000 dollars I would have saved $3,000 (if I would have received the same rates from the bank and Moneycorp), and if I were to transfer a million… well, you get the maths.

Overall Experience with Moneycorp

I have had two experiences with Moneycorp. Firstly I contacted them when I was residing in the U.S and had to provide a lot of documents to sign up, and then they could not provide me with the service I need for U.S dollars to Chinese Yuan before my year abroad in China. The second time I contacted them was very different – a U.K address is verified easily, I had exclusive rates (As you can receive by using my referral link), and I needed to move USD to GBP – it was a piece of cake and I learnt a lot while doing it! Thank you Moneycorp! It was surely a fun review.